How To Clear Undeposited Funds In Quickbooks Online

Fill in any missing or relevant information that will contribute to a more comprehensive record of the deposit. If you come across any payments that should not be included in this particular deposit, leave them unchecked for now. These payments will remain in the undeposited funds account until you are ready to include them in a future deposit.

Advanced Methods for Clearing Undeposited Funds

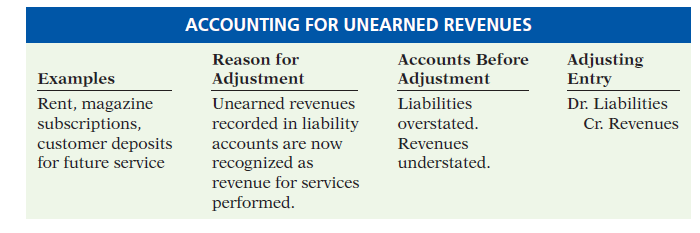

Let me share some insights on how to clear it out and how undeposited funds work in QuickBooks Online. You can always tag me on this thread if you need assistance tracking and managing your sales transactions. However, the “Deposit To” option is not available in the “Customer Payment” windows for the undeposited funds I need to clear up (see attached). Now that I’ve shown you a very common reason for old payments in Undeposited Funds, I’m going to show two methods for cleaning up those old payments, so you can get your books in order.

Step 2: Create a Bank Deposit

- In some cases, you may encounter a situation where some payments remain uncleared or unmatched.

- Once done, click Save and close or Save and new to complete the deposit.

- When you’re ready to clear undeposited funds, you will create a new bank deposit in QuickBooks Online.

I’d be glad to help share additional information about clearing up your undeposited funds account. With your deposit slip in hand, you can record a bank deposit and combine the payments in QuickBooks. All payments in the Undeposited Funds account automatically appear in the Bank Deposit window. All of my undeposited funds are already in a deposit and cleared through the bank and reconciled already.

Best Accounting Software for Small Businesses of 2024

To simplify the deposit process, Intuit provides printable deposit slips. Once you have completed your deposit in Quickbooks, you can print the deposit slip, which can be customized with your company’s name, address, and banking information. Ordering printable deposit slips is easy on the Intuit marketplace. If you’re new to QBO, you may be unfamiliar with what we are referencing when we say the ‘Undeposited Funds account’.

In this guide, we will walk you through the steps to clear undeposited funds in QuickBooks Online. We will explain the concept of undeposited funds and why it is important to clear them. We’ll also provide you with a step-by-step process to help you confidently clear undeposited funds in your QuickBooks Online account.

It does this by allowing you to group cash and paper checks into a single deposit, mirroring how banks process and deposit your payments. When reviewing your transactions, it’s easier to spot discrepancies and missing deposits since your QuickBooks records align with the combined deposits on your bank statement. Think of the undeposited funds account as a virtual cash register or a temporary safe where you can store customer payments until you’re ready to deposit them. This feature is especially beneficial if you receive multiple payments throughout the day or week and want to combine them into one bank deposit. Think of undeposited funds as a virtual cash register or a temporary safe where you store your customer payments until you’re ready to deposit them into your physical bank account.

We’ll have to delete the deposit and use the pending one on the undeposited funds. In bookkeeping, your primary goal is maintaining a high accuracy level. When you match every dollar in with every dollar out, it’s easy to keep an eye on your transactions and manage in case of any financial discrepancies.

Most QuickBooks Online users find it easier to always post to the Undeposited Funds account first, and then enter the deposit into QuickBooks Online separately. Doing this does result in an additional step, but memorizing one way of recording payments is easier than having to remember multiple processes. Ensure your financial statements are accurate by mastering the art of reconciling your bank and credit card transactions in QuickBooks. Choose your customer from the drop-down menu and their open invoice will automatically show up on the list.

It is crucial to maintain a clear trail of documentation to support the deletion, such as notes detailing the reason for the adjustment and any approvals required. Transparency is key, and any changes made should be well-documented what is cost incurred and easily traceable. You’ll want to edit the Deposit to account of the recorded payment. This removes the transaction that shows up in the bank deposit section. Review the transaction details carefully to ensure their accuracy.

If you find any discrepancies or errors in the listed payments, such as incorrect amounts or incorrectly recorded transactions, take a moment to correct them before proceeding. This will ensure that the bank deposit accurately reflects the payments you intend to deposit. However, when I check my chart of accounts, the 1000 Checking Account godaddy bookkeeping review: features and pricing QuickBooks balance has increased by the amount of undeposited funds. Managing finances is critical to running a successful business, and staying on top of overdue payments is an everyday challenge entrepreneurs and accountants face. One powerful tool that has revolutionized financial management for businesses of all sizes is QuickBooks.

If you’re using a different accounting software, make sure to check if a similar feature exists or if you need to handle customer payments differently. In your case, it appears that you matched the payments with the bank deposit downloaded via Banking Feeds, which explains why the deposits on your bank statement were cleared. Now, to clear the balance in your Undeposited Funds account, we have two options to avoid duplicate deposits. In this write-up, we’ll talk about the process to delete or undo a deposit in QuickBooks Desktop and Online for both funds. Making duplicate deposits, incorrectly adding checks, or adding deposits to the wrong customers are some of the common QuickBooks errors that can be experienced by users. So let’s resolve such issue by understanding how to delete or undo a deposit in QuickBooks desktop and online.

Once done, click Save and close or Save and new to complete the deposit. Using your deposit slip as a reference, combine the check and cash payments with a bank deposit. Once you provide all the required details, click Save or Save and send on the lower part of the screen. Your payment will be recorded automatically in the Undeposited funds account.

Undeposited funds act as a temporary holding account for customer payments, providing a streamlined approach to manage cash flow and simplify your bookkeeping process. Double-check that the deposit to account in the transaction matches the appropriate bank account where the funds were actually deposited. This will facilitate accurate reconciliation with your bank records. To select a payment, check the box next to it in the bank deposit form. You can choose one or multiple payments to include in the deposit.

Or just make one giant deposit and drop down a line and enter your income acct. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. You can also search by invoice number instead of customer name. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

The debits and credits work – they net to zero on the General Ledger – but QBO’s Undeposited Funds register and its relationship to the Bank Deposit window do not. I’ve taken some circuitous steps in the past to successfully clear other issues in QBO, but nothing works in this scenario. I’ve also spoken with Pro Advisor support specialists at length who also could not solve this.

When it comes time to reconcile an account, you have your bank statement in one hand and QuickBooks Online in another. In the “Account” field, select the appropriate bank account where you will eventually deposit the funds. This scrap definition should be the same account that corresponds to your actual bank statement. Now that we understand what undeposited funds are and why they’re useful, let’s explore why it’s crucial to clear undeposited funds in a timely manner.

While the bank balance is your bank’s actual balance from the last bank feed update. If the Bank balance is lesser than your QuickBooks balance, there might be bank transactions that are causing the difference. Since you’ve mentioned that the funds have already been deposited, cleared through the bank, and reconciled.

Say we received a $1,700 check payment from Aaron Berhanu for a heating, ventilation, and air conditioning (HVAC) installation invoice. Regularly reconciling the Undeposited Funds account with the bank statement can help in detecting and rectifying any inconsistencies. Now, when you check the Bank Register for your checking account, you can see the deposit posted for the correct amount. Continue entering payments received from your customers until all payments have been entered. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction. Your customer has given you a payment for goods purchased or services rendered.

Select the bank account where an improper deposit was made from the Select Account drop-down menu. Checks that are received are deposited into the account for the undeposited fund after being applied against sales receipts or invoices. These checks are consolidated into a single deposit transaction when they are placed in the bank using the undeposited fund’s account. If you eliminate that deposit, all of the checks ought to resurface in the undeposited funds account. Once verified, the payments should be deposited into the appropriate bank account, and the transactions should be reconciled to reflect the accurate financial status. These funds serve as a temporary holding account and allow for grouping multiple payments together before depositing them into the designated bank account.