Wave Accounting Review 2024: Features, Pricing & More

They were censured and the firm was fined US$30,000 after inspectors found multiple violations of accounting rules deemed to be “reckless” if not purposeful. In June, the PCAOB—the U.S. regulator for audits of U.S.-listed public companies—sanctioned a ninth Vancouver firm. Public Company Accounting Oversight Board (PCAOB) had levied hundreds of thousands of dollars’ worth of fines and numerous practice restrictions double‐entry bookkeeping against eight B.C. Firms that are responsible for the lion’s share of audits of B.C. In March, CPABC had proposed an amendment to the Chartered Professional Accountants Act, the profession’s enabling legislation, to add “protection of the public interest” to its legislated objectives. This platform is perfect for anyone that wants to automate and outsource the headaches of running a business.

- While Wave’s free accounting software doesn’t limit you to a certain number of invoices, customers, or transactions, certain features and automations are now only available by subscribing to Wave Pro.

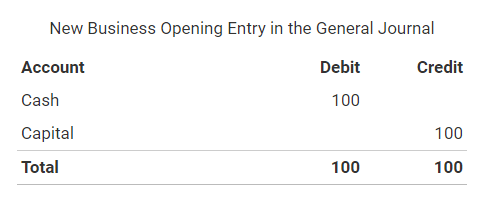

- It also complies with accounting standards and uses double-entry accounting, which can help ensure accuracy.

- However, the Mexican unauthorized immigrant population is down from a peak of almost 7 million in 2007, when Mexicans accounted for 57% of all unauthorized immigrants.

See all small business payroll features

Wave accounting is free, and makes a point of its everyday usefulness for nonprofits, noting that users don’t need training as an accountant to implement it. Additionally, Wave’s double-entry accounting makes it easy to pass books on to an external accountant when that becomes necessary. In this Wave accounting review, we’ll tell you everything you need to know about this user-friendly, free accounting software. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity.

How to create invoice?

Wave Payroll has two options starting at $20/month plus $6/month per employee. Tax service payroll is available in 14 states, while self-service payroll is available in the remaining 36 states. If you’re looking to gain a firmer grasp of your business’s finances, Zoho Books offers excellent budget management features for as low as $15 per month.

Employee access

Wave is cloud-based software that boasts a solid set of accounting features suitable for most small businesses. In our last review, we found these features especially appealing because they were all completely free with no artificial limits. Unfortunately, Wave has recently updated its pricing model to now include a paid plan. Now, many standard features (such as automatic importing of bank transactions) are only available if you purchase a monthly or annual plan.

Create a TechRepublic Account

Accountancy software is a vital tool for a business’s financial well-being. We understand this well at Tech.co, and it’s why we make sure every recommendation is research-backed and quantifiable. You can check out our comparison table to see how Wave compares against the top accountancy providers, too. Doing payroll manually involves confusing and time-consuming calculations. Not to mention the stress of worrying about making errors and winding up in a tax audit (yikes!). In self-service states (all other 36 states) Wave Payroll does not make payments or file on your behalf.

How is Wave different than QuickBooks?

And, in the long run, an online payroll software provider like Wave can save you a lot of money by reducing human error so you can avoid tax penalties (and who doesn’t love saving money?). To review Wave, we set up a free Wave Accounting account that we used to create invoices, record sample transactions and generate financial reports. We also read verified Wave Accounting and Wave app reviews on third-party sites like Gartner, Trustpilot, the App Store, Google Play and more.

This makes Wave unable to handle taxes in countries like Australia where prices must be quoted inclusive of all taxes, such as GST. There is no way to set an invoice total and have Wave calculate the tax portion as a percentage. We did the research, and it seems there are no Wave accounting coupon codes or discount vouchers at this time. Let us know how well the content on this page solved your problem today.

The offers that appear on the website are from software companies from which CRM.org receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all software companies or all available software companies offers. As noted up and down this article, Wave has become one of the most popular accounting software platforms for small businesses and freelancers out there. The customer support team is very responsive and helpful, according to most Wave accounting reviews. They seem to be knowledgeable about the software and able to solve most issues quickly.

Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption. We built our payroll tool for small business owners, so it’s easy to use AND teaches job order costing vs process costing similarities and differences you as you go. Create beautiful, free invoices that reflect your business branding. Automate overdue reminders, set up recurring bills, and add notes or terms of service with ease.

“It’s not just a cool piece of software, it is giving peace of mind to people.” You deserve to know your taxes aren’t something you have to sweat over the entire calendar year.” Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada how to account for outstanding checks in a journal entry take control of their finances. Monitor your cash flow, stay organized, and stop sweating tax season. On the other hand, immigrants from all other regions were about as likely as or more likely than the U.S. born to have at least a bachelor’s degree. Immigrants from South Asia (72%) were the most likely to have a bachelor’s degree or more.

Wave’s smart dashboard organizes your income, expenses, payments, and invoices. Have an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends.

QuickBooks Online also has hundreds of integrations, connecting your accounting solution with other small business software and apps. On the other hand, QBO only supports up to 25 users on its most expensive plan. Additionally, QuickBooks does not have a free plan like Wave, with prices starting at $30/month.

Wave accounting free features include expense tracking and income and sales tax tracking. You also get unlimited bank and credit card connections, and integrations with PayPal, Stripe, and more. Then there’s the mobile apps for iOS and Android, double-entry accounting, and automatic backups.