How to Add a User in Xero

By broadening the user network in Xero, businesses can streamline their financial workflows and enhance communication between team members. Adding users in Xero facilitates better management control, allowing specific permissions to be granted, ensuring data security and privacy. This expansion also leads to improved scalability, enabling businesses to accommodate growth without compromising on user access and functionality within the platform. Therefore, the addition of new users in Xero is pivotal for fostering a collaborative and well-organized work environment.

What Are Some Tips for Managing Users in Xero?

This collaborative effort streamlines the exchange of financial data, enabling real-time communication and access to up-to-date financial information. By adding users in Xero, businesses can harness the expertise of external financial professionals to gain valuable insights, strengthen internal controls, and ensure accurate financial reporting. It promotes a transparent and unified approach to financial management, paving the way for improved decision-making and enhanced business performance.

Step 5: Choose User Permissions

By customizing access levels, organizations can maintain data security, prevent unauthorized actions, and enhance overall control. The ability to adjust access levels ensures that employees have the necessary tools to perform their tasks while safeguarding sensitive information. It plays a crucial role in upholding compliance standards and responding to dynamic business needs as they change over time.

What is the access level of Xero users?

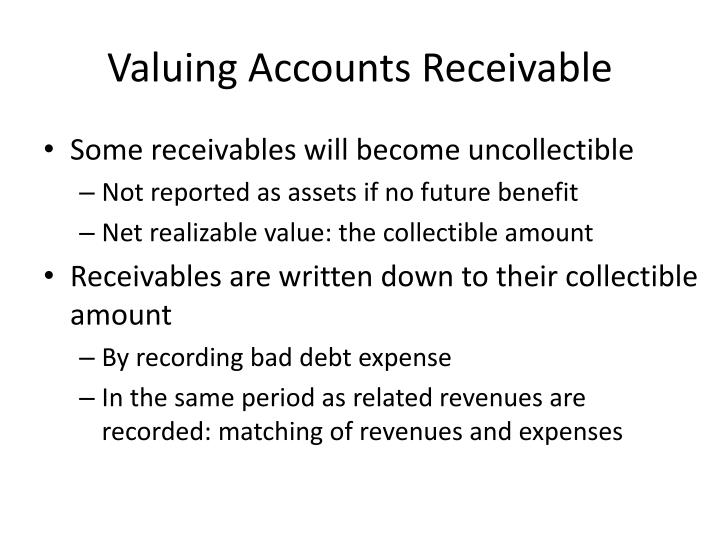

By removing inactive users, organizations can minimize the risk of unauthorized access to sensitive financial data, enhancing overall data security. Optimizing user counts ensures efficient usage of licenses and reduces unnecessary costs. It also simplifies the user management process, allowing administrators to focus on active users’ access and permissions. This proactive approach to user cleanup and access management contributes to a well-organized and secure Xero environment. The roles available in Xero include Adviser, Standard, and Invoice Only, each with distinct access levels. Advisers have full access to the organization’s financials and settings, while Standard users can view and edit most areas but cannot access sensitive financial information.

From the ‘Settings’ menu, users can also configure individual user-related settings such as roles, permissions, and notifications. It plays a crucial role in streamlining the administrative controls, allowing the customization of user access levels and security measures. This practice not only streamlines the process but also empowers different team members to take ownership of their designated responsibilities. By allocating tasks quickbooks online 2020 effectively, companies can improve their overall operational efficiency, ensuring that every financial aspect is handled with precision. It enables better financial management, as different users can focus on their expertise areas, leading to detailed scrutiny and strategic decision-making. Delegating tasks through user addition in Xero ultimately contributes to a comprehensive and organized approach to handling finances.

Understanding the Administrator Permission Level

Regularly reviewing and updating user access helps in managing the Xero account effectively and safeguarding sensitive financial information. Deactivating or deleting a user in Xero is a critical aspect of user management, allowing businesses to maintain access control and streamline user permissions. This process ensures that former employees or individuals who no longer require access to financial data are removed, thereby reducing the risk of unauthorized access. By deactivating or deleting users, financial intermediary definition businesses can also streamline the allocation of permissions, ensuring that each user has the appropriate level of access for their role within the organization. This not only enhances security but also helps in maintaining the integrity of financial data by restricting access to authorized personnel only. It plays a pivotal role in ensuring that the right individuals have the appropriate level of access to sensitive financial data, thereby safeguarding against unauthorized use or potential breaches.

- This level of access allows the advisor user to delve into the financial data, generate comprehensive reports, and provide valuable insights that can aid in strategic decision-making.

- These users are entrusted with the crucial responsibilities of setting up and maintaining employee records, processing payroll runs, managing leave balances, and generating payroll reports.

- If you’re new to the software, you may be confused about how to add a new user to your organization.

- After entering the user’s details, proceed to choose the appropriate permissions for the user, specifying the level of access and functionality they will have within the Xero system.

This process ensures that the newly added users receive the necessary access credentials and permissions to start using Xero efficiently. By sending bulk invitations, the administrative burden is significantly reduced, allowing for a more streamlined approach to access provisioning. Effective user management is integral to maintaining the integrity and security of financial data within Xero.

Collaborative features in Xero enable seamless communication and teamwork among users, promoting efficiency in financial processes. This is particularly beneficial for small and medium-sized businesses, as it allows team members to work together seamlessly without any compliance issues. Users can be added with varying levels of access permissions, ensuring that sensitive financial information remains secure. Xero’s user-friendly interface simplifies the process, and with the option to add additional users as the business grows, it becomes a scalable solution for enhancing collaboration and productivity.

On the other hand, a read only user won’t have access to inventory, budgets, bank reconciliation, and the settings. Note that you can add an unlimited number of users on Xero, and they can access the information in the cloud at the same time. Cashbook only users have restricted access to the cashbook functionality, suitable for those handling accounts payable or receivable. Reviewing this data regularly is crucial for security, compliance, and operational transparency. For example, if a Standard user changes roles in your organization, you may want to downgrade them to Read-Only access. It’s important to keep user information current so you can easily contact them if needed.

Therefore, focusing on managing users in Xero is crucial for a secure and efficient financial management system. Xero’s bulk invite feature offers a convenient method for adding multiple users simultaneously, streamlining the process of scaling user access and collaboration within the platform. Assigning the user’s access level, such as standard or advisor, is a crucial step in defining their permissions and privileges within the Xero platform. Entering the user’s details, including their name, email, and designated role, is an essential step in adding a new user to Xero for personalized access and permissions.

The available options for permissions usually include roles like admin, standard user, and custom permissions. Regular reviews of user permissions are essential to ensure that users have appropriate access and are only able to perform necessary starting or ending a business 3 internal revenue service tasks. To initiate the process of adding multiple users, the first step is to access the ‘Users’ section within the Xero platform. Admin rights should only be granted to those overseeing financial data and managing user roles.